The onsite C&I market is struggling in the face of high transaction costs and financing limitations. (Credit: Walmart)

Starting next year, offsite corporate deals are expected to become the largest source of business-led solar procurement in the United States.

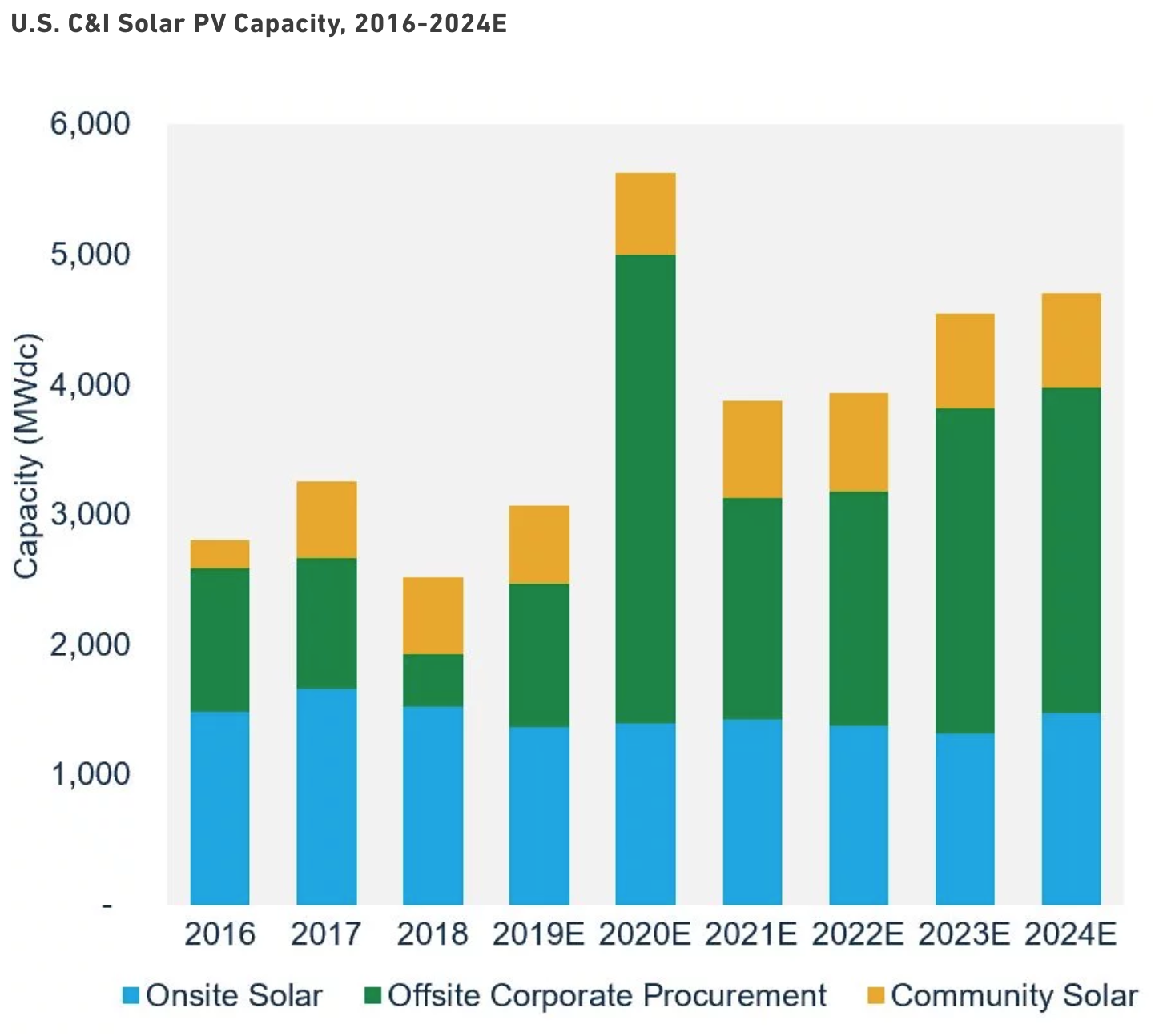

Procurement from offsite solar power-purchase agreements is expected to triple between 2019 and 2020, and will remain the largest source of business-led solar procurement through 2024, while onsite commercial and industrial solar remains relatively flat.

At the Solar Energy Industries Association’s recent Solar Goes Corporate event, Colin Smith and I shared new research on changes to C&I solar in the U.S., including how the competitive landscape of the growing offsite solar market will diversify as more developers enter and grow in the space.

The rise of utility-scale

Onsite solar installations have dominated the C&I market to date, but the landscape is shifting rapidly, according to Wood Mackenzie.

The robust pipeline of utility-scale projects with corporate offtakers will be one of the biggest drivers of solar market growth over the next two years, as the U.S solar market as a whole grows by 17 percent in 2020 and 39 percent in 2021.

The C&I market spans several segments of the solar industry: Larger utility-scale solar, community solar and smaller behind-the-meter distributed solar.

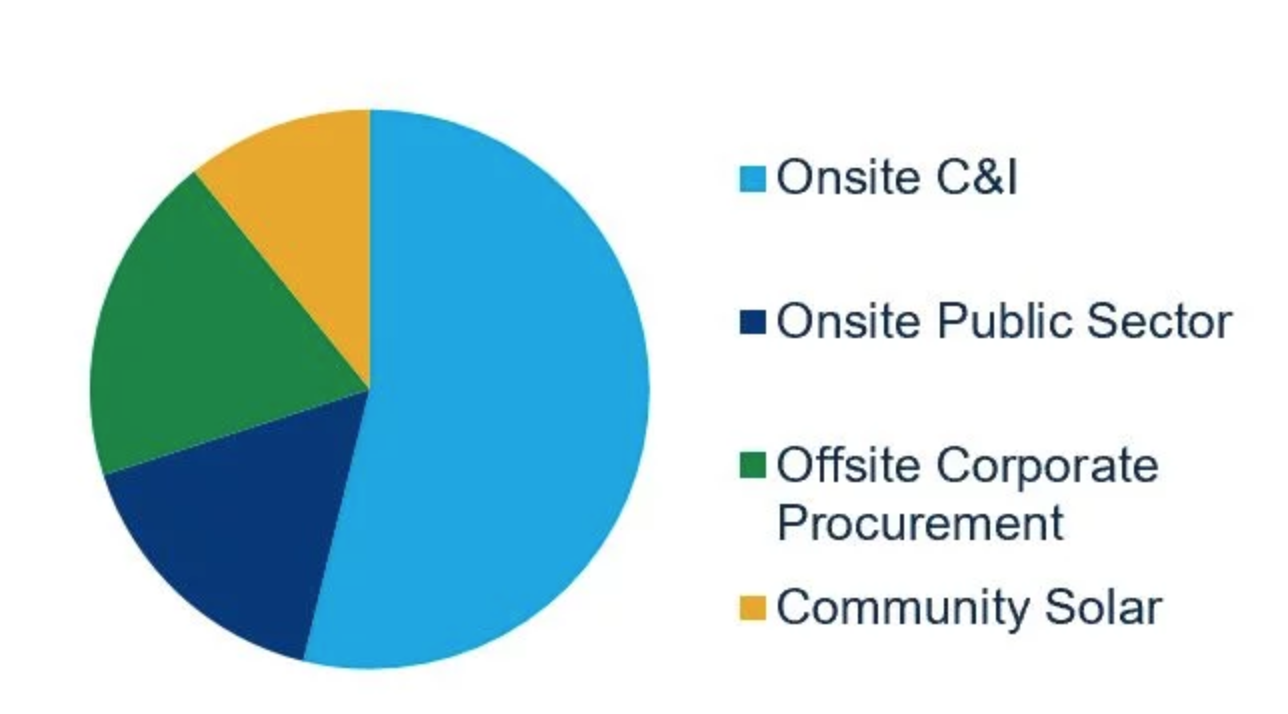

To date, many businesses have chosen onsite solar, which delivers higher returns than offsite and often takes advantage of unused roof space. About 70 percent of cumulative C&I solar installations to date are onsite.

Cumulative U.S. C&I Solar Installations by Type Through Q2 2019

Source: Wood Mackenzie’s How C&I Customers Are Shaping Utility and DG Solar Markets

However, the onsite C&I market continues to be challenging due to high transaction costs and financing limitations.

The onsite market reached a peak in annual deployments in 2017, at slightly under 2,000 megawatts, but it isn’t expected to come near that megawatt threshold again in the next five years.

Meanwhile, demand for offsite utility-scale C&I solar is increasing. The current pipeline of corporate offsite projects that have announced 2020 completion dates stands at over 4 gigawatts.

U.S. C&I Solar PV Capacity, 2016-2024E

Source: Wood Mackenzie’s How C&I Customers Are Shaping Utility and DG Solar Markets

A shifting competitive landscape

While today the top five offsite solar developers command 49 percent of that market, the offsite solar space is diversifying rapidly as more developers enter the segment and experiment with business development strategies.

Many of the developers with large offsite C&I pipelines today are not the developers with the most megawatts already deployed, showing how new players are moving to establish themselves.

Data firms will continue to be the top customer for offsite C&I solar, as they can take advantage of utility-scale PPA rates due to the large, concentrated electric loads from their data centers.

In cases where utility-scale PPAs may be too risky for a particular customer, many companies subscribe to community solar projects, which straddle the lines between onsite, distributed solar and offsite, utility-scale solar. While most community solar capacity is currently secured by corporations and C&I customers, these projects tend to be 5 megawatts or less in size.

Community solar will grow in 2020 and will see even more growth 2021, thanks to new community solar programs that are taking shape, such as those in New Jersey and New York.

A driving market force

Taken together, the various segments of the C&I solar market will continue to make up 22 to 32 percent of the total U.S. solar market. As corporations and businesses become increasingly driven to set clean energy targets and achieve sustainability goals, these customers will come to represent a growing segment of the solar industry.

***

Michelle Davis is a senior solar analyst with Wood Mackenzie and author of the report How C&I Customers Are Shaping Utility and DG Solar Markets.